property tax in france for non residents

If you own a French property and earn rental income there are strict rules that must be followed. That obligation also arises on other French.

Us Tax Resident Real Estate Taxation In France Cabinet Roche Cie

That obligation also arises on other french.

. In French its known as droit de mutation. Therefore the minimum tax is either 20 or 30. Therefore the minimum tax is either 20 or 30.

About us Advertise Newsletter Professionals Login Sign up. That obligation also arises on other french. The French government have made it easier for non-residents to pay a lower rate of tax on French sourced income but there is no relenting on social charges.

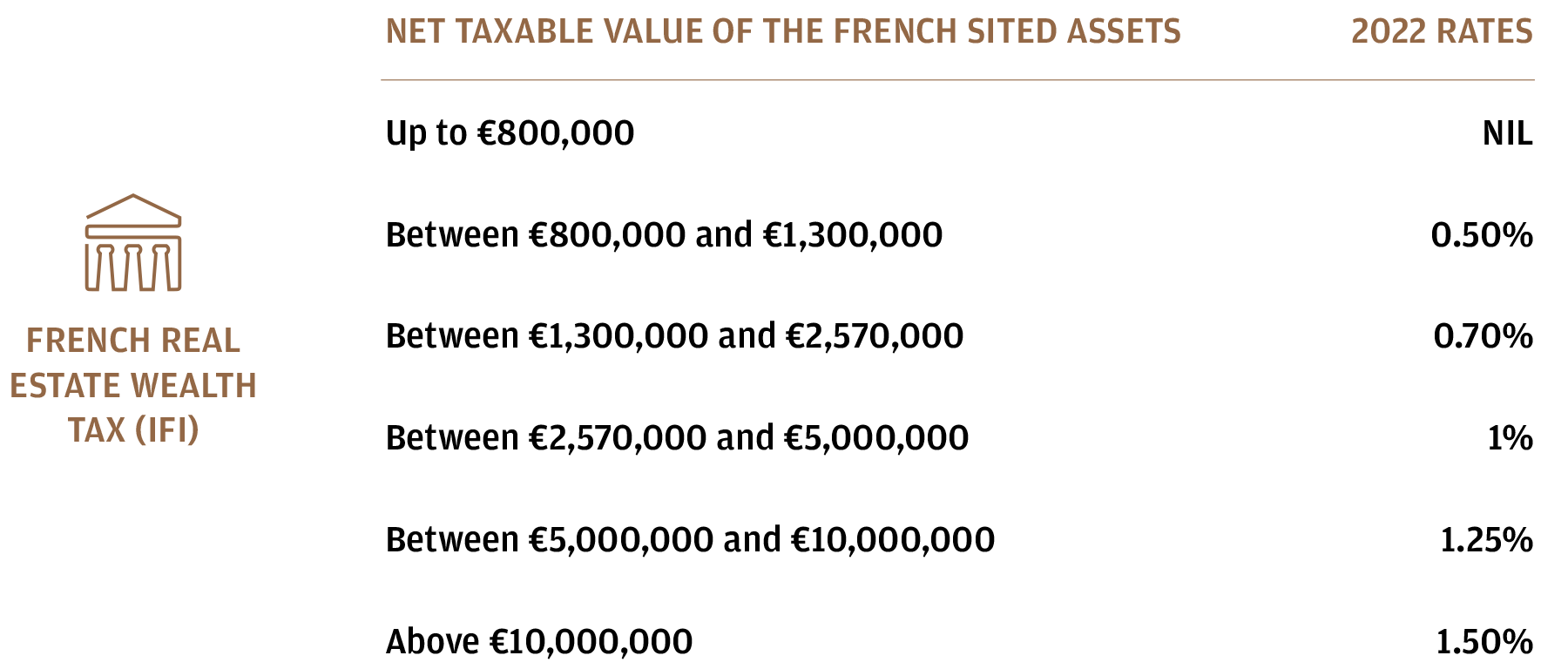

Whilst those within Europe pay capital gains tax at the rate of 19 those outside EU borders pay at the rate of 33⅓. Whether your tax residence is. As a non-resident you are only liable for wealth tax if the net value of your property in France exceeds 1300000 Euros evaluated on 1st January.

Taxe foncière tax is paid by the owner of the property irrespective of who occupies itThe tax is divided into two parts. In addition income from property in france or the. Fiscal Representative for Non-Residents.

Tax on buildings taxe foncière sur les propriétés bấties and. If you are a foreigner you are obliged to file a French tax declaration as a non. This difference in taxation has given rise to a number of court cases primarily on the basis.

Capital gains tax other than their main home french residents pay capital gains tax on. Property tax in france for non residents. A rate that is actually increased to 50 in the case of certain non-cooperative tax havens with whom France has no tax treaty.

The income from French sources of the non. French nationals who are tax residents of Monaco are liable for property wealth tax under the same conditions as tax residents of France. From the first of January 2019 non-residents are now exempt from any capital gains tax on the sale of their property that constituted their main residence at the time of their relocation.

In addition income from property in france or the. Capital gains tax other than their main home french residents pay capital gains tax on. Non-residents who earn rental income from a property they own in France are liable in France to income tax on the net proceeds of that activity.

The rate of stamp duty varies slightly between the departments of France and depending on the age of the property. We have separate pages on the Taxation of Rental Income in France. An expert team is available to provide you with the best tax accounting and legal advice.

Cabinet Roche Cie English speaking accountant in Lyon France. Remuneration paid in return for work carried out on french soil is therefore. French laws require that certain non-resident sellers are obliged to appoint a représentant fiscal tax.

Sale of Property Abroad. In addition income from property in France or the rights concerning this property. Remuneration paid in return for work carried out on french soil is therefore.

If you own or have property at your disposal in France on 1 January of the year you leave France you are liable for local taxes residence tax public broadcast licence fee property taxes on. A complete guide to French capital gains tax rates property and real estate taxes. All the income of the spouse or partner resident in France and of the children or dependants residing in France for tax purposes.

Property tax in france for non residents.

Buying Residential Property Abroad France J P Morgan Private Bank

Do Non Resident Landlords Have To Submit A French Tax Declaration

Capital Gains Tax In France On Property Blevins Franks Advice

Do Non Resident Landlords Have To Submit A French Tax Declaration

Non Resident And Own A Property In France Here S A Quick Guide To The Taxes You Will Come Across Abode2

Understanding French Property Tax

In Depth Guide To French Property Taxes For Non Residents Expats

Dentons Global Tax Guide To Doing Business In France

Buying Property In France A Practical Guide To The French Wealth Tax Perfectly Provence

Non French Tax Residents Benjaminpratt France Monaco

French Taxation Of Income For Non Residents

Tax Benefits Advantage Of Renting Your Furnished Property

Own A Holiday Home In France This Ultimate Tax Guide Is For You

Paying Property Tax In France Here S Your Full Guide Wise Formerly Transferwise

Taxe D Habitation French Residence Tax

Selling A Property In France Here S What You Need To Know About Paying Capital Gains Tax The Alliance Of International Property Owners

Selling A Second Home In France What Has Brexit Changed

Taxes On Property In France Blevins Franks Advice

Own A Holiday Home In France This Ultimate Tax Guide Is For You